Business plan good practice guidance

By reading this guidance you'll get help with how to develop a business plan, including basic headings and prompts on how to review your plan as it develops. It also includes a list of further resources and a glossary of terms to do with business planning.

Please note: if you already have a business plan, you don’t need to produce a new one.

Writing your plan

Before producing your business plan, consider:

- if you need expertise in areas such as market analysis, taxation or legal matters

- who will be involved in writing the plan, including staff and trustees

- the timelines for the business plan to be approved

The headings below give a basic framework for developing a business plan, but every organisation is different so you may want to use different headings or additional content that better explains how your organisation works:

- executive summary

- about the organisation

- governance and management structures

- strategy

- market appraisal and current approach

- financial appraisal

- risk register

- monitoring and evaluating the organisation

- organisational impact assessment

- contact details for the organisation

- appendices

Once you have a draft it’s a good idea to review it to assess its strengths and weaknesses, tackle any gaps and ensure it’s as clear, concise and logical as possible.

Your business plan will be a document you refer back to continually and update in the general course of running your organisation, so ask yourself:

- Does your business plan present a strategy for achieving your aims and your mission?

- Does your business plan align with our Heritage 2033 investment principles?

Executive summary

Your plan should start with a concise overview (no more than two pages) highlighting the most important information in the document, including:

- an overview of your organisation including your mission statement and what you want to achieve

- the organisation’s key aims for the period of the plan (usually 3–5 years)

- key elements of your strategy including how you will assure the longer-term financial future of the organisation

- the main risks facing your organisation and how you plan to manage these in the short, medium and long term

- an explanation of how your organisation is resilient enough to meet challenges: likely including financial information, how you will ensure governance and management structures are fit for purpose, and the monitoring and evaluation processes you have in place

- any additional key information

Review this section by asking:

- Is it a well-structured summary highlighting key points from the plan?

- If someone with no prior knowledge of your organisation read this summary on its own, would it make sense?

About the organisation

This should provide information on the structure, objectives and activities of your organisation, including:

- when and why it was started

- its purpose, aims and key successes

- the key areas of activity, products and/or services that you deliver, how they are distinctive and how will they be developed over the course of the plan

- details of the targets you have set for each area of activity

- Legal status, eg: unincorporated association or trust, or incorporated by Act of Parliament, Royal Charter, as a company limited by shares/guarantee, (Scottish) Charitable Incorporated Organisation or Industrial and Provident Society. Indicate whether it is a Community Interest Company or is registered or recognised as a charity.

- whether it has a membership of individuals, and if so the number of members

- the names of any other entities with which it has a formal association (eg: any bodies with which there are funding agreements or that have the right to nominate multiple board members)

- Whether it is a partnership of different organisations with a shared interest, identifying the other organisations/stakeholders you will be working with, the basis of the arrangement and whether it is formal or informal. Summarise any partnership agreements.

- the number and roles of paid staff (in total and full-time equivalents) and explain the tasks they perform within the organisation

- the role of volunteers (give estimates of the number of regular volunteers, the tasks they do within the organisation and the total number of hours they work on each task every year)

- describe how you fund your organisation’s activities, noting any sources that account for a particularly large proportion of your income and, if these come from a funding body, when this funding will be subject to review

Review this section by asking:

- Have you accurately described your organisation’s purpose and main areas of activity and how you are distinctive?

- Do you highlight key successes?

- Is it clear what services or products you offer and how you intend to develop them?

- Have you set clear targets?

- Is the structure of your organisation clearly set out in a way that is easy to understand?

- Have you included key information about your legal set up and how you staff and fund core activities?

Governance and management structures

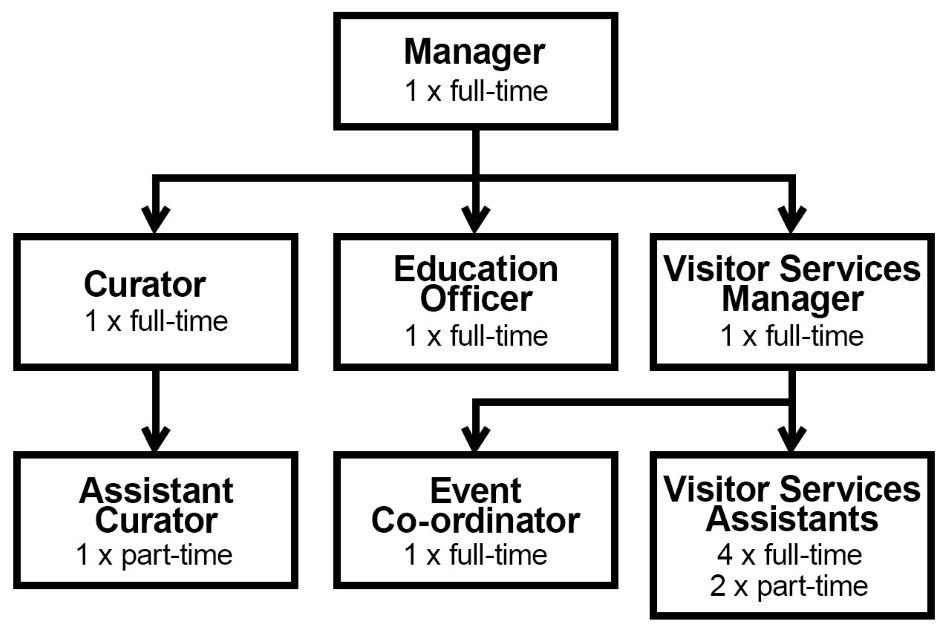

This should explain your organisation’s management structure, decision-making processes, lines of communication and reporting. It can include simple organograms/network diagrams to show your governance, management and staffing structures.

Governance summary

This should provide an overview of the governance in place within your organisation to ensure that business plans and strategies are approved and monitored.

Describe the size and composition of the governing body (eg: council, board of trustees, board of directors) and, where appropriate, arrangements in place for succession planning and board development training. List the roles covered by your senior management team.

You should explain the make-up of your board. This includes how the board provides a diversity of perspective and skills. You should also explain their engagement with the organisation, particularly in relation to:

- business planning, pricing policies and marketing strategies

- financial management and administration

- fundraising

- approving potential projects and maintaining oversight

- commissioning advisers and consultants

Summarise the functions of any sub-groups, describing their membership, roles and responsibilities, and specifying any delegated powers they are authorised to use. Indicate how frequently such groups meet.

Management structure

You should include simple organigrams or network diagrams. These should show each job title. There’s no need to include individuals’ names.

Show how many post-holders are employed in each position and whether they are full-time, part-time or volunteers.

An accompanying schedule should list each role, summarising its purpose and function, and the name of the post-holder (so we can see if there are vacancies in key roles).

You should provide information on your recruitment policies for core staff. If you use external advisors regularly, you should give details of their company and role and how they relate to the positions on the organogram.

Volunteers

If volunteers are a key part of your organisation, you should explain:

- the roles volunteers play in the organisation, including the types of responsibilities they have

- how many volunteers the organisation works with

- the number of volunteer hours

- the role within your organisation responsible for managing volunteering and how this is monitored

Review this section by asking:

- Have you covered how your organisation is managed and governed in a clear way? Is there any information missing?

- Have you included the main challenges you face in running your business?

- Is it clear what skills and experience are needed going forward? Have you included information on how you develop skills within the organisation?

- Have you included plans for developing your structure and processes in the future?

Strategy

This should include a more detailed overview of the aims of your organisation for the period of the plan and how they relate to your overall mission, setting out the key activities you will undertake to achieve them.

Include any projects you plan to take on, demonstrating how they will work together to achieve your organisation’s aims. You should include information on the impact additional projects will have on your organisation and how you plan to deal with those impacts.

Include dates and a timetable for reviewing and updating your strategy.

Market appraisal and current approach

A market appraisal looks at your offer within the context of the marketplace. You should assess your market, your competition and your marketing strategy. Market analysis should be proportionate to the scope and size of your organisation.

Describe your current market:

- Is the profile of your heritage attraction or place of local or national interest? Is it well known?

- Is it valued by a wide cross-section of the public or a more limited special-interest group?

- How many customers have you had each year over the past 10 years?

- What are the demographics of your current customers and visitors – their age, gender, income, education, and occupation? What proportion are family groups/schools?

- Where do they live – very locally, from the surrounding region, from the UK or overseas?

- What proportion of customer contacts are repeats?

Show you know your market:

- On a national or regional basis, is your market growing, falling or stable?

- How does this relate to your organisation’s experience?

- Are there any national socio-economic trends or policies that will have an impact on your market?

- How might foreseeable political, economic, social and/or technological changes affect your market?

Consider your potential/target audience:

- Who are the people most likely to access your service?

- Are they single or repeat customers?

- What are their needs, behaviours, tastes and preferences?

- What has research shown you so far?

Review the competition

All organisations have competition of some sort. Find out what organisations are in competition with yours. Look at how they price their activities, their business strategy, strengths and weaknesses.

Develop a competitive strategy for your organisation

Do a ‘SWOT’ analysis looking at the strengths, weaknesses, opportunities and threats to your organisation.

Use evidence-based information and remember to include internal and external factors. Describe what is unique and special to your organisation and include the disadvantages you have.

Outline your marketing strategy

A marketing strategy is how you will reach new audiences. It will likely be based on evidence from:

- data you have collected, over as long a period of time as is achievable

- national data, for example, the Taking Part survey (in England), national tourism surveys, national and local authority statistics

- existing market research

- market research commissioned to estimate potential markets and the potential popularity of the business with your target market

- reviewing operations that are similar to those you propose in your own area and further afield, using annual accounts available online from the Charity Commission (England) or Companies House

Your marketing strategy should clearly set out:

- people: who your target audiences are, including the size of these audiences

- product: what you’re offering people

- price: your pricing strategy and the rationale behind it

- promotion: the communication channels and messages you will use to reach your target audiences

Financial appraisal

This should include a general financial assessment of your organisation, an overview of your total financial need to support your day-to-day operations and details of your financial model, including your main sources of funding.

Provide supporting documents in an appendix at the end of your business plan, detailing:

- a forecast income and expenditure account

- a cashflow forecast showing the expected monthly cashflow

- statements of assumptions underlying the forecasts

Detail the assumptions made in your calculations. An assumption is anything you are relying on to make forecasts. For example, the average number of visitors you are expecting based on the previous year, or any unknown costs of materials. Make sure you also include details of any reserves.

You may want to undertake a sensitivity analysis to show what your finances would look like if your projections fall short by various amounts, for example between 5% and 20%. What would the risk to your operation be if either of these scenarios were to occur and what action might you need to take?

Review this section by asking:

- Have you described how your organisation operates financially in a way that is easy to understand?

- Have you included an overview of your total financial needs, what your main sources of funding are and how your main activities contribute to achieving this?

- Have you included an expected cashflow forecast and income and expenditure forecast?

Risk register

A risk assessment identifies your organisation’s internal weaknesses and external threats. A risk register, usually set out as a table, lists all the identified risks prioritised in order of importance.

For each risk, outline:

- the nature of the risk, eg: technical, market, financial, economic, management, legal

- a description of the risk

- the probability of the risk happening: low, medium, high or as a percentage

- the effect the risk could have, eg: on cost, time, performance

- the level of effect: low, medium, high, or as a percentage

- how you would prepare for and lessen the risk’s effect

Review this section by asking:

- Have you listed the key potential problems that your organisation faces?

- On reflection, are they your main risks or can the list be reduced?

- Have the risks been properly calculated?

- Do you need to do any further thinking about how risks will be mitigated?

- Are there any alternative courses of action that have not been considered?

Monitoring and evaluating your organisation

In this section you should set out your plans for monitoring and evaluating your organisation's performance and impact to ensure you are meeting your aims and achieving your mission.

You will need to gather different kinds of information at various stages, starting at the earliest opportunity by benchmarking where you are to start with. You should set a series of milestones, financial targets and performance targets to track these.

Evaluation should be carried out regularly using the monitoring information. You should summarise your planned approach and include details of milestones. Your approach should show when you anticipate evaluating your achievements and specify the scope of the evaluation and whether your organisation plans to bring in any expertise to help you assess the extent to which you are meeting your aims.

Review this section by asking:

- Have you included details of the changes you want your organisation to make? How does this link to your mission and aims?

- Have you set out how you intend to monitor progress? Will you need any external advice?

- Have you detailed what success looks like? How will you know if you have achieved your targets?

- Do you have a plan for linking your findings into future decision-making? How do you report back to your board of trustees?

Organisational impact assessment

Within your application we want to see how your proposed project will impact your organisation and its finances and continue to deliver against our investment principles for a period of five years from the end of the project, including:

How will any additional costs created by the project continue to be funded?

These can include additional staffing and housekeeping costs, business rates, maintenance obligations arising from implementing management and maintenance plans (and, if applicable, conservation plans). Document these additional costs in a table.

Where the project is expected to lead to reduced expenditure (for example, reduced energy expenditure, productivity gains due to improved technology), include the costs of the savings in the table to give the planned net additional cost or saving.

What additional volunteer input will be required?

Tell us about additional numbers of hours to be worked and the number of additional hours required. Indicate where these volunteers come from and the impact on your volunteer management and training arrangements.

Are there any changes in governance or management that could affect the project?

Tell us about any relevant changes to board composition or committee structure, or variation in individual duties or responsibilities. If the structure will be different during different phases of your project, provide separate diagrams to explain the arrangements. Outline any other material change in how the organisation will be managed as a consequence of the project.

Provide the following financial projections:

A statement of unrestricted funds, or of income and expenditure where the organisation is a local authority, university or other large organisation and the scale of the project is immaterial to the organisation's total financial circumstances. Where the organisation has a trading subsidiary, its projections should be consolidated with those of its parent. Include:

- the organisation's balance sheet

- the assumptions on which the financial projections are based

- a sensitivity analysis

In carrying out this impact assessment you should:

- Use the market appraisal you have carried out in your overall business planning to give details of your market size and the income generated. The assumptions should clearly show the basis on which the numbers have been calculated.

- demonstrate that the general trend will be for the organisation to generate annual surpluses on its unrestricted funds

- Base your assessment on your latest completed financial year if you have been in existence for that length of time (or the current year budget). Use this as a starting point for your projections so you can clearly assess the net impact on your financial position from the incremental, on-going income and expenditure caused by the project you are proposing.

- Include in the sensitivity analysis the income items that are most critical to the organisation's success, are most uncertain or contain the greatest risk. By adjusting these by percentages between 5% and 20%, depending on their nature and risk, it is possible to see the impact on the reported surplus.

Contact details for your organisation

At the end of your business plan, include:

- head office address

- website

- telephone number

- email address

Appendices

If you need to include additional information to support your plan, for example, evidence or reports you have commissioned, external advice, financial information or visuals which support the plan, add these as appendices.

When you have completed the plan, review your appendices to make sure you haven’t missed any relevant detail. Check whether you have included information in the main business plan that should be listed in the appendix instead.

Additional resources

- Sample business plans for various industries.

- Business planning guidance for arts and cultural organisations commissioned by Arts Council England for the arts and cultural sector.

- The Sustainable Sun tool: 10 steps towards financial sustainability from the National Council for Voluntary Organisations.

- An introduction to benchmarking, developed by The Audience Agency.

- How to build a measurement and evaluation framework, developed by New Philanthropy Capital.

- Impact and evaluation resources from the Small Charities Coalition

- DIY toolkit on how to invent, adopt or adapt ideas that can deliver better results, created by Nesta, the UK’s innovation agency. It includes a template for SWOT analysis.

- Various business planning resources from the Scottish Council for Voluntary Organisations.

- Various resources to help you run your organisation from the Wales Council for Voluntary Action.

- Resources and templates relating to business planning, including a template for developing a cashflow, from the Small Charities Programme.

Glossary of terms to do with business planning

Aims: a broad statement of intent.

Asset: an item of value owned and controlled by the organisation that has a useful life longer than a single accounting period.

Budget: a plan for future activity expressed in terms of incoming and outgoing resources.

Cashflow: the pattern of an organisation’s income and expenditure. Having surplus cash in hand after being able to meet all debts on the day they are due is a ‘positive’ cashflow, not having cash to meet debts as they fall due is a ‘negative’ cashflow.

Forecast: a financial projection, based on performance to date, of where the organisation expects to be at the end of the current financial period. Revised forecasts are often prepared throughout the financial year.

Impact: the intended or unintended sustainable changes brought about by an initiative, project, programme or organisation.

Mission: the overall guiding direction of the organisation, which usually states your purpose, refers to what your organisation does, who it does it for and what is unique or different about what you do.

Objectives: achievements set out for a business to aim for, often within a certain timeframe. These should be ‘SMART’, ie: specific, measurable, achievable, realistic and time-based. They underpin planning and strategic activities and serve as the basis for performance monitoring and evaluation.

Trustee: a person who has independent control over, and legal responsibility for, an organisation’s (especially a charity’s) management and administration. Find out more about trustees on the Government’s website.

Sensitivity analysis: tests different scenarios to see how they will affect your bottom line, for example by increasing and decreasing your financial projections by between 5% and 20%.

Unrestricted funds: money that can be spent on any activity that furthers the organisation’s purpose.